Strategy & Forecast

Group Strategy

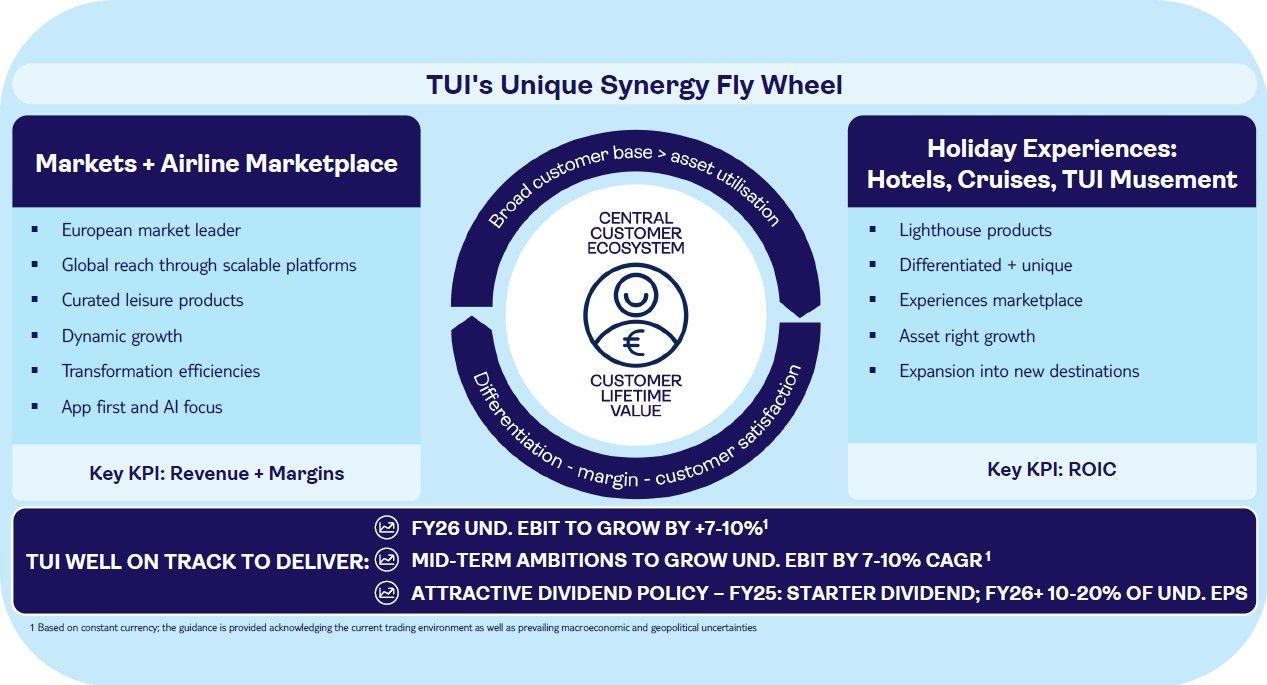

Leveraging Our Unique and Integrated Business Model to Drive Higher Growth and Shareholder Value

Strategic Priorities

Our unique business model focuses on integration and differentiation across Holiday Experiences and Markets + Airline. Our strategy is embedded in one central customer ecosystem, underpinned by our Sustainability Agenda and by our people. We are accelerating profitable growth by maximising customer lifetime value and leveraging synergies using our Markets + Airline distribution powerhouse to drive superior performance in Holiday Experiences. We are transforming TUI into a scalable, platform-based global curated leisure marketplace, offering more products to more customers through integrated brands. We are building a more agile, cost-efficient business with higher speed to market, delivering additional shareholder value.

As a next step in developing new vertically integrated destination clusters, we signed a strategic alliance agreement with the Sultanate of Oman's Tourism Development Company OMRAN Group to position Oman as a leading year-round sun-and-beach destination. The long-term partnership centres on constructing and operating a first cluster of five new hotels in Salalah under leading TUI hotel brands, welcoming guests from as early as winter 2028. Oman will contribute land and capital to a joint venture (OMRAN 45%, TUI 45%, private investor 10%), while TUI contributes its expertise in hotel operations, distribution, airlines, and experiences, driving end-to-end profitability through our vertically integrated model. OMRAN will also become a 1.4% strategic shareholder in TUI, acquiring newly issued shares at €9.50 per share with a 3-year lock-up period. In exchange, TUI will receive its 45% stake in the joint venture as contribution in kind, with no cash contribution required.

Our global platforms strategy transforms TUI from local operations into an integrated global business through a modular, layer-by-layer approach (sourcing, production, sales), accelerating delivery, while ensuring we are AI-ready. Our Mindtrip partnership exemplifies this. Customers can now use AI to plan and seamlessly book complete travel packages in one place via the "Book with TUI" button, while also benefiting from the added security of TUI's comprehensive crisis support and traveller protection that comes with package holidays.

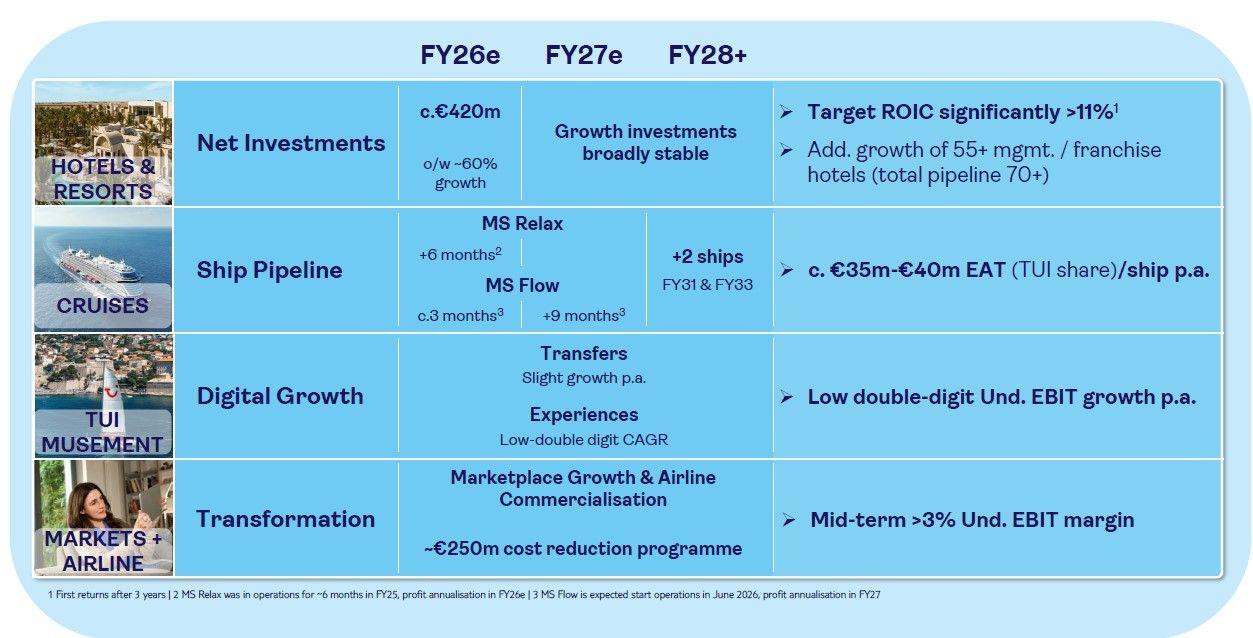

Capital Allocation Framework

We remain firmly committed to our capital allocation framework. Our focus is on driving profitable growth and improving cash flow through organic growth, disciplined investment and portfolio optimisation. Our disciplined investment strategy for FY26e includes net investments of €860m to €900m. Over 60% of Hotels & Resorts investments will be directed into growth, especially in RIU and Robinson and be fuelled by vertical integration. We are also strengthening competitiveness in Markets + Airline through fleet modernisation with B737 MAX aircraft, alongside investments in Cruises (Marella Cruises), IT and other strategic areas. We expect investments from FY27 onwards to be broadly in line with FY26e levels, subject to Boeing deliveries and financing.

We are targeting a further strengthening of our balance sheet metrics with net leverage to improve to below 0.5x in the medium-term.

The significant operational and financial progress we have made has been recognised by all three major rating agencies during the year, which have returned us to BB/Ba territory and thereby already achieving our mid-term target. S&P upgraded us to BB-, Moody’s to Ba3, and Fitch with an inaugural rating at BB. All three agencies assign a stable outlook.

New Dividend Policy

In line with our previous guidance and following our significant operational progress and substantial improvements to our financial profile including the full hand-back of German state aid, we are pleased to announce our new shareholder return strategy.

Our enhanced financial strength now enables us to deliver meaningful returns to shareholders while maintaining the operational flexibility needed to capitalise on growth opportunities and to further improve leverage. This strategy represents a sustainable, long-term approach carefully designed to align with TUI's group structure, cash flow profile, and shareholder expectations.

The balanced approach demonstrates our confidence in the business and our commitment to creating sustainable value for all stakeholders. It marks our transformation into a more resilient, profitable, and shareholder-focused organisation.

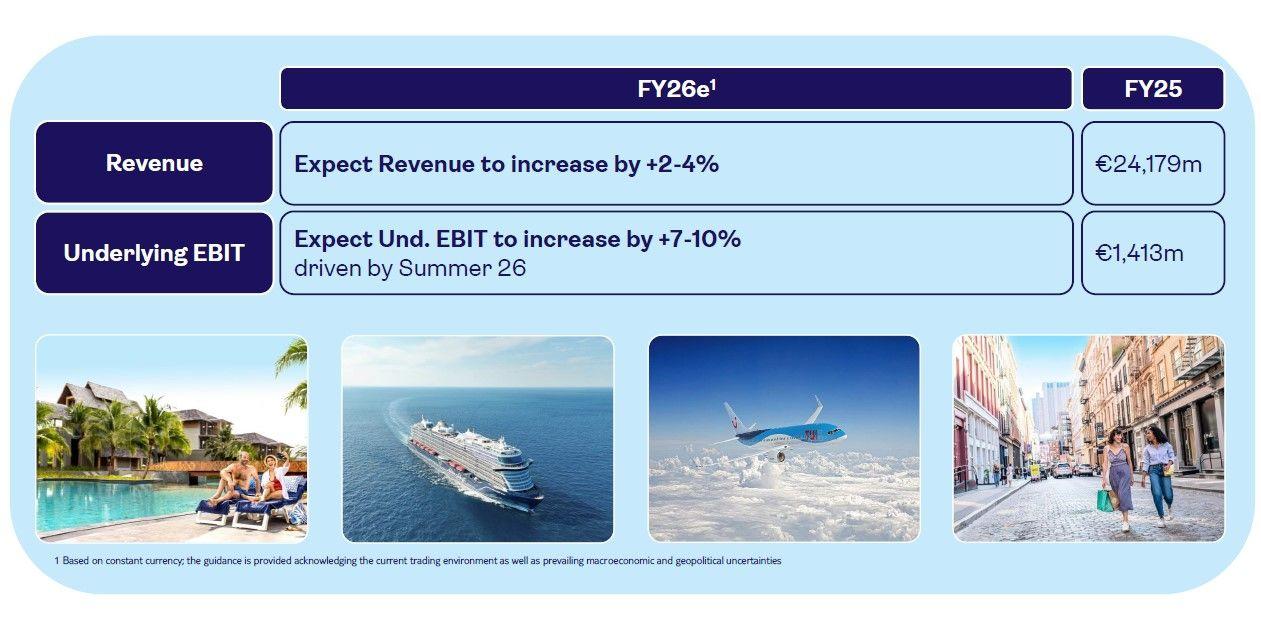

FY26 Guidance

- We expect revenue to increase by +2-4% (FY25: €24,179m)

- We expect underlying EBIT to increase by +7-10% driven by expectations for Summer 2026 (FY25: €1,413m)

Mid-Term Ambitions

We have a clear strategy to accelerate profitable growth by maximising the customer lifetime value and leveraging the synergies between both our business divisions. We are focused on creating a business which is more agile, more cost-efficient and achieving a higher speed to market with the aim to create additional shareholder value. We are well on track to deliver on our mid-term ambitions as follows:

- Generate underlying EBIT growth of c. 7-10% CAGR

- Target to improve net leverage3 to below 0.5x

- From FY26 onwards dividend payout ratio of 10-20% of underlying EPS1

Sustainability (ESG)

As an industry-leading Group, we want to set the standard for sustainability in the market. TUI’s Sustainability Agenda consists of three building blocks - People, Planet and Progress.

Our near-term targets align with Paris Agreement goals:

- by 2030, we aim to reduce CO2 emissions per air passenger by 24%(CO2e/rpk)4

- cut cruise emissions by 27.5%(tCO2e)5

- and reduce hotel emissions by 46.2% (tCO2e)5 compared to 2019 levels.

These targets are validated by the Science Based Targets initiative (SBTi), ensuring they reflect current climate science findings. In FY25 we delivered on our SBTi targets across all three segments, achieving reductions versus our FY19 baseline of -7.8% (-0.9%pts improvement vs. FY25 target) in Airline, -5.5% (-2.5%ptsimprovement vs. FY25 target) in Cruises and -17.5% (-2.5%ptsimprovement vs. FY25 target) in Hotels & Resorts, demonstrating our commitment to measurable climate action. Building on this progress, we're committed to achieving net-zero emissions across our operations and supply chain as well as becoming a circular business by 2050 at the latest.

Vertical integration propels growth & customer satisfaction: strong & resilient HEX business boosted by M+A marketplace